Mining

Stakeholders welcome new mining minister amidst mineral export ban

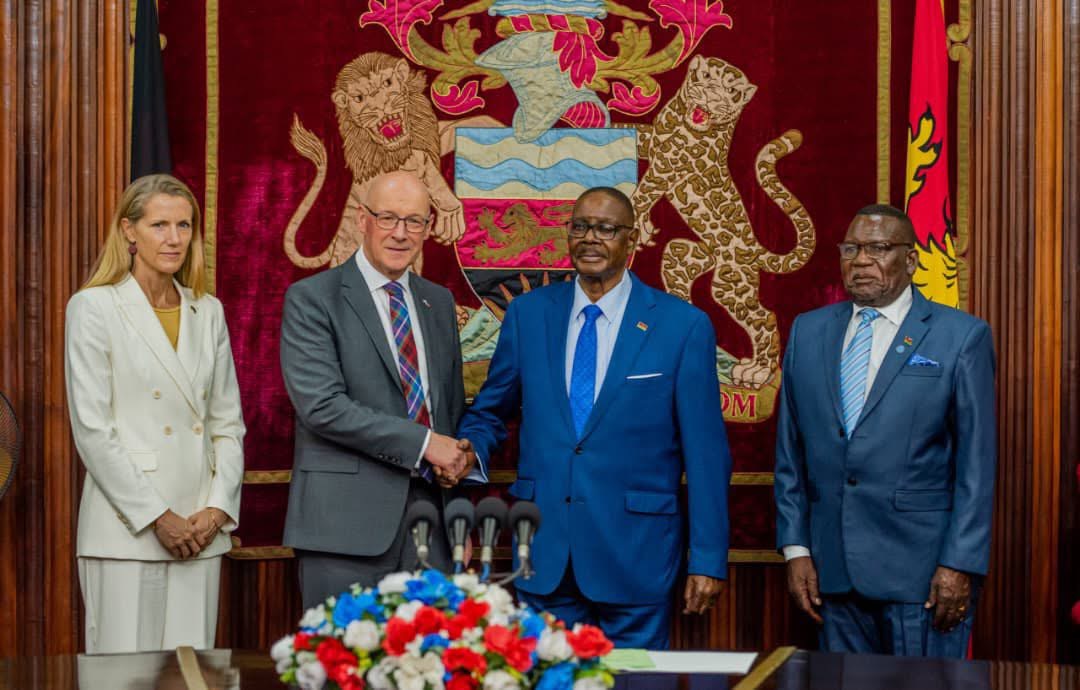

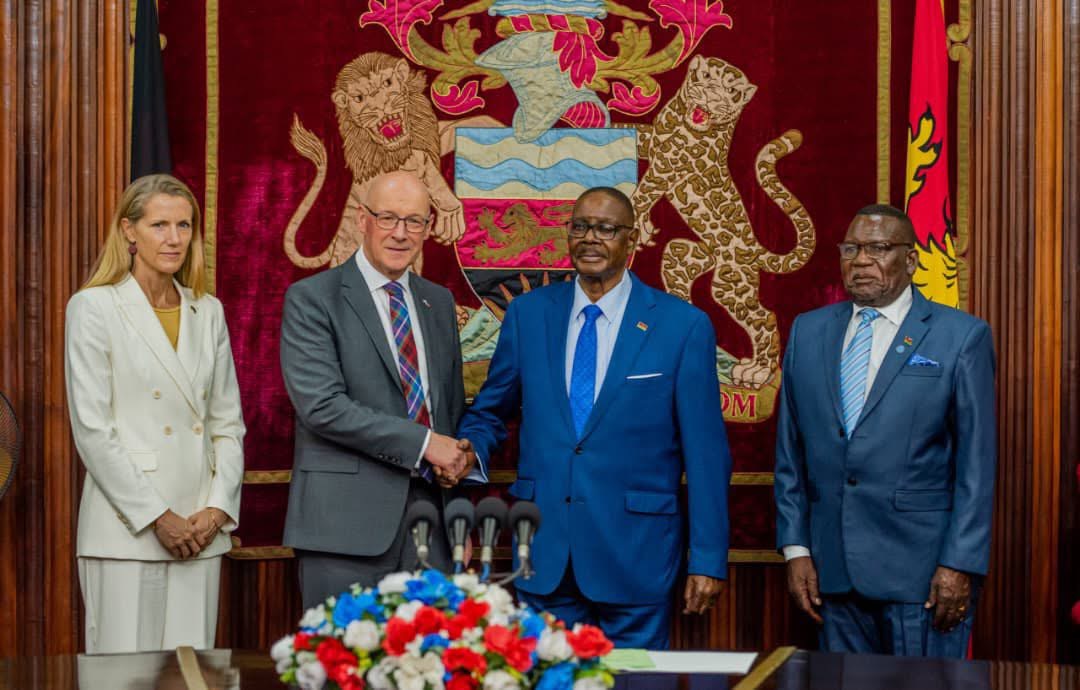

ASX-listed Africa-focused resources group Globe Metals & Mining says Malawi’s Mines and Minerals Regulatory Authority (MMRA) has it granted a further 12-month extension to commence substantial mining operations at the Kanyika Niobium Project in Mzimba. The new deadline is 27 September 2026.

Under the Mining Development Agreement (MDA) signed with the Government of Malawi in March 2023, Globe was initially required to commence substantial mining operations within eighteen (18) months of execution. The first deadline of 29 September 2024 was extended by twelve (12) months to 27 September 2025.

Globe Metals Interim CEO & CFO Charles Altshuler reports that that on September 26, 2025, Globe received formal written confirmation from MMRA that the MDA remains valid and in full effect, and a further twelve (12) month extension to commence substantial mining operation has been granted.

During the past twelve months, the Company has advanced key preparatory activities to position the project for development, including: • Early contractor engagement and preliminary infrastructure planning.

Altshuler, however, states that several conditions remain under the Government’s primary responsibility and are essential before substantial mining operations can commence including: Completion of the 32 km access road from Chatoloma junction to site, delivery of the 17 MW electricity infrastructure. and finalisation of resettlement and compensation for project-affected households.

“While Globe has made progress over the past 12 months, our efforts alone could not satisfy the Government’s commencement conditions in the absence of the above-mentioned critical Government works and community processes,” he says.

He, therefore, explains that accordingly, a 12-month extension has been granted, providing Globe the opportunity to align all parties and advance the project to the stage of substantial mining operations through the following activities:

Relocation of affected households by the regulatory authorities in accordance with the approved resettlement framework is expected to take place during Q2 -Q3 2026.

Altshuler says: “We thank the Government of Malawi and the Malawi Mines and Minerals Regulatory Authority for their continued support of the Kanyika Niobium Project. The granting of this extension reflects the collaborative approach between Globe and our host government as we advance the Kanyika Project.”

“Over the past year we have delivered key milestones, including signing the Community Development Agreement, advancing our Export Processing Zone approval, and engaging with potential cornerstone investors and offtake partners.”

“With this extension, we are positioned to complete the resettlement process, progress infrastructure works and deliver community programs in partnership with government and stakeholders.”

“The Kanyika Project represents a once-in-a-generation development for Malawi and a critical contribution to the global supply of niobium. We are proud to advance it responsibly and transparently, in alignment with the Government and all our stakeholders.”

“Globe reaffirms its commitment to progressing the Kanyika Niobium Project in a transparent, responsible, and Environmental, Social, and Governance (ESG)-aligned manner, consistent with the expectations of the Government of Malawi, MMRA, and local stakeholders.”

ASX-listed resources firm Kula Gold has rolled out exploration work for Niobium and Tantalum at its Wozi Project in Central Malawi, following promising results from a recent soil sampling programme.

The Wozi Niobium Project, located 225 kilometers north of the capital Lilongwe, covers an area of approximately 5.52 square kilometers within the Mozambique Orogenic Belt. The project sits on Precambrian to Lower Palaeozoic basement rocks and hosts niobium mineralisation contained in the mineral pyrochlore within a nepheline syenite stock.

Kula Gold’s MD Ric Dawson said in the statement that the move marks the company’s first major expedition into the critical minerals sector in Malawi.

He said the company has initiated a targeted reverse circulation (RC) drilling programme to quickly assess the site’s potential and define its value.

“Subject to results, we will consider engaging a specialist rare earths partner to support technical development and subsequently seek the best corporate options to add value to Kula’s shareholders,” Dawson said.

He reported that the soil sampling programme involved 238 samples collected along east-west orientated lines at 200-meter intervals, with 50-meter spacing between samples along each line.

The laboratory analysis, conducted by Intertek in Johannesburg, South Africa and Perth in Australia confirmed highly anomalous niobium concentrations along the contact zone of the nepheline syenite stock.

The programme identified a robust +0.4% Nb₂O₅ soil anomaly stretching 1.5 kilometers in strike and averaging 200 meters in width, with a peak value of 1.08% Nb₂O₅. Low tantalum and uranium ratios in the samples suggest the potential for direct reduction to ferro-niobium (FeNb)”.

Kula Gold also reported that the soil sampling results have provided clear drilling targets, with a maiden drilling programme scheduled for November 2025. Field activities will include additional rock-chip and soil sampling as well as mapping to confirm historic niobium and tantalum trenching results.

Dawson said renewed global interest in critical minerals, combined with Wozi’s proximity to other major niobium and rare earth projects in Malawi, encouraged Kula Gold to accelerate its exploration activities.

“Field activities at Wozi are about to get in full swing to progress initial ground truthing. First assays from our trenching are expected this quarter, with the important follow-up maiden drilling to follow soon,” Dawson said.

Wozi project benefits from good road infrastructure and a low-cost location, which will help reduce operational expenses. Historical exploration drilling has not been conducted on the site, meaning the current programme will be the first systematic assessment aimed at defining a potential resource.

While Wozi is now a key focus for Kula, Dawson emphasized that the Mt Palmer Gold Project in Australia remains the company’s core asset.

He described Wozi as “a quick, high-impact value-add potential to our portfolio without diverting significant resources.”

With the successful completion of soil sampling and the upcoming drilling programme, Kula Gold aims to rapidly assess the scale and economic potential of its niobium deposit.

Niobium is a critical mineral used primarily in high-strength steel alloys and emerging technologies, making it a strategic addition to Malawi’s growing portfolio of mineral resources.

Central Malawi is also host to the world’s largest rutile deposit and second largest deposit of natural graphite at Kasiya in Lilongwe.

ASX-listed Sovereign Metals is conducting feasibility studies for the Kasiya-Rutile Project.

The mining sector has a tremendous potential to create wealth for the country and create economic linkages that will boost urbanization and the development of commercial agriculture. There is need to introduce effective economic infrastructure and governance systems that resonate with all stakeholders. Quick wins are in the development of uranium, niobium, rare earths, rutile and graphite.

Malawi Vision 2063 states that “Mining has tremendous potential to develop and support the inclusive wealth creation agenda”. This is through three pillars that are in this paper. These are Agriculture Productivity and Commercialisation, Industrialisation including Mining, and Urbanisation including Tourism.

The author believes that under

Pillar 1, Agriculture Productivity and Commercialisation, mining can provide a market for agriculture products to feed the mines through technical and financial support to cooperative farming in food crops, livestock, and fisheries production. Rock phosphate is available for extraction and for the production of phosphoric acid.

Pillar 2, Industrialisation through Mining, offers an opportunity for mineral value addition, research, science, and innovation. There is an opportunity to export highvalue mineral products such as uranium, niobium, rare earths, graphite, and titanium (rutile/ilmenite). There will be massive direct and indirect job creation and foreign reserve generation (wealth creation).

Pillar 3, Urbanisation including Tourism, will benefit from the creation of mine towns and cities with improved health, education, and reticulated water facilities. The towns and cities will also trigger high consumption of agricultural products. Urbanization will increase demand for industrial minerals such as cement, sand and aggregate, iron and steel, and ceramic clays.

The above scenario can be achieved in the medium to long term if the following enablers are prioritized and given special attention.

Provision of modern transportation links such as tarred roads and rail lines, electricity, and financing mechanisms through development finance will go a long way towards speeding up the development of the mining sector.

Mineral resource endowment is spread throughout the whole country. There is a need to develop cheaper transport modes such as lake services and rail linkage to Monkey Bay Port. Chilumba and Nkhata Bay ports need to be rehabilitated. Migowi –Nambazo, Migowi – Songwe, Mangochi – Makanjira, Likuni – Malingunde, Makawa – Njereza, Chitipa Junction – Kayelekera, Kasungu – Chikowa, and Chamono – Kanyika roads need to be upgraded to provide easy transportation of mineral products.

Provision of electricity for mine development is a backbone for mineral development. EGENCO has a total installed generation capacity of 441.95MW, with 390.55MW from hydro power plants and 51.4MW from thermal power plants. The mining sector requires about 500MW in the medium term, and this is posing a big challenge for mine development. This energy demand is required by 2025. Efforts for regional power interconnection, thermal power development and green energy production are recommended.

The realization of wealth creation from mining requires long term financing instruments. On average projects earmarked to kickstart the wealth creation agenda for the country require a capital of US$ 200 million per project. This will need long term financing instruments of loan payback period of between 3 and 6 years. There is need to establish a Development Finance Institution (DFI) with credible lines of credit and State-Owned Enterprise (SOE) to manage state equity and diversification of mature projects to Malawians.

Key players that should finance the sector include Malawi Agriculture and Industrial Investment Corporation (MAIIC), Standard Bank, FDH Bank, National Bank and yet to be recommissioned Malawi Development Bank. We need to understand that apart from monetary gains from mining, there are also other benefits such as urbanization, job creation and economic infrastructure and social services.

The mineral sector in Malawi faces a negative public perception on how it is governed and how government has arranged its fiscal regime. There is need to relook at the mining legal framework to be relevant with private sector growth and bring about institutional transformation and restructuring that brings efficiency and transparency in the management of revenue from the mining sector.

Public perception shows that government has no capacity and human resources to govern and monitor what is happening in the minerals sector. As a result, it is losing revenue through smuggling of minerals and illicit financial flows. This needs to be corrected. There is a formal sector and informal sector. The formal sector is made up of exploration companies and industrial minerals mining companies. Exploration companies have been sending samples for analysis to accredited laboratories. This has been viewed as exporting mined minerals in the name of samples. Companies mining industrial minerals such as coal, limestone and aggregate are doing it in a formal setting and reporting their production and revenue to Ministry of Mining and Malawi Revenue Authority. We now need civic education to prove to the nation that these samples are necessary and have put Malawi on the map in discovering high value minerals such as uranium, niobium, rare earths, graphite and rutile.

The informal mining sector is made up of artisanal and small-scale miners (ASM). These are mining gemstones and gold. These are characterized by smuggling and social decay and illicit financial flows. Unfortunately, their activities are denting the whole mineral sector. Government needs to come out to explain what is happening and how it is going to deal with this sector in terms of formalization, support to training, financing, and marketing.

We need to protect our exploration companies from undue criticisms and apathy. The hold the key to wealth creation for the country.

The fiscal regime determines how the revenues from mining projects are shared between the government and companies. Fiscal tools are used to create a fiscal regime to govern mining projects. These tools include fees and taxes are in form of royalties, income tax, resource rent tax, withholding tax on dividend and interest, import duty, VAT and state equity. In order to foster equitable benefit to government and the resource company, there is a need to come up with an exclusive taxation act that also be backed up by a customs procedure code that is exclusive to mining. Any fiscal item capping needs to be removed from the Mines and Minerals Act in order to be flexible in coming up with equitable benefit sharing.

In totality, the total government revenue should not exceed total investor revenue as this will attractive the investor to invest in mining as he bears the risks associated with mining.

This is a serious issue in Malawi. The public thinks resource companies are rich and smugglers. These are a group of risk taker businessmen who mobilise capital from syndicated banks and stock exchanges. They create jobs, stimulate economic linkages and bring skills development and technology. Let’s engage them on evidence-based issues not speculation. There are laws and regulations that spell out offences and penalties.

Let’s promote positive thinking to develop the mining industry.

Recent and current exploration activities place two groups of mineral projects that can take off within the next three years. These are for export and import substitution. Export and valuable projects include Kayelekera uranium, Kanyika niobium, Kasiya rutile and graphite while those for import substitution include cement, coal, iron and steel, glass sand and ceramic clays. Import substation minerals will play a big role in promoting growth of towns and cities.

The following interventions need to be undertaken with speed and patriotism to get out of the current economic mess:

For the mining sector to contribute to wealth creation in the shortest time possible there is need to respond positively in terms of building positive relationship between government, the public and resource companies. The key players are the Ministry of Mining, the Ministry of Finance and Economic Planning, Ministry of Trade and Industry and Malawi Revenue Authority. These need to come up with a fiscal regime that offers equitable economic and financial benefit sharing.

The keys players for making this vison to be realized and effective are resource companies, formalized ASMs in form of Cooperatives and Development Finance Institutions. Offshore financing can be leveraged though local banks through management of lines of credit. This is possible with Standard Bank, National Bank, First Capital bank and New Building Society bank.

The role of academia and research institutions is crucial in providing relevant skills and technology necessary to sustain the development of the minerals sector. Academic and research institutions should build partnership with the private sector through internship and opportunities for collaboration with academic institutions in solving the industry’s problem using undergraduate and postgraduate students during their research assignments. Possible collaboration partners in this area are Malawi University of Business Applied Sciences, Malawi University of Science and Technology, and University of Malawi. Research Institutions involved soil science and geotechnical studies are key to provide solutions in various stages of mineral development.

Development of high value mines are possible through building Public Private Partnerships (PPP) and building trust between stakeholders in mining. These include government, resource companies and the public. Promoting value addition in partnership with private sector and academia will build strong economic linkages for job creation.

Mining offers great opportunity to industrialize the country and promote urbanization. Through mining, countries create wealth and skills necessary to bring technological innovations. Job creation and improvement of goods and services in the agriculture sector get boosted.

Collective effort to support this sector will promote good governance, economic growth, economic linkages, development of economic infrastructure and favourable macroeconomic conditions that will bring confidence to the private sector and the country’s citizens.

The country needs to unite for a purpose of graduating from poverty to prosperity. Let us all bring the change that all we need to be in.

The Mining and Mineral Resources Regulatory Authority (MMRA) says the process of installing mining officers at every district will only target those districts where mining activities are taking place.

In an interview with Mining and Trade Review, Director General for MMRA Samuel Sakhuta said the plan was to decentralize all districts but due to limited resources they will only start with districts experiencing an upsurge in mining activities.

Sakhuta said MMRA will fast track the process following a growing number of issues reaching his desk, which he feels would have been dealt with at district level.

He said: “To enhance collaboration between MMRA and district councils on mining activities within their jurisdictions, the Authority plans to recruit adequate staff to work with district councils.

“We will collaborate on mining activities to ensure effective regulation and oversight at the local level,” Sakhuta said.

Miners including those in Artisanal Small-scale Mining (ASM) from the mining districts walk long distances to have documents processed at the Department of Mines offices in Lilongwe, Blantyre and Mzuzu; which necessitates the recruitment of the District Mines Officers.

The officers are also required to address the information gap in rural communities on medium to large scale mining projects in their localities which result in prolonged tension and conflicts between communities and the mining companies.

Commenting on the development, Programs Coordinator for Natural Resources Justice Network (NRJN) Joy Chabwera said it has been a long time ever since the network started advocating that the Ministry deploys officers in districts.

Chabwera advised the Authority to ensure that it deploys competent officers with strong Public Relations (PR) attributes in the districts to deal with the existing problems.

He said: “This is not new. It has been long overdue. Since 2019 we have been asking the Ministry of Mining to deploy mining officers in the hotspot districts but this never happened till now.”

“For MMRA, we can give them the benefit of a doubt that they are new so perhaps they will deliver to their promises.”

“But here is an advice to them, they should deploy competent technocrats to handle this work not just anybody”

“They should also consider having a strong PRO to be able to respond to queries and share information to communities in areas where mining is taking place.”

Chabwera also urged the Authority to fulfill its promise to ensure that the process is fast tracked since it has been long since government started singing the song.

However, Mining Expert and Geoscientist Ignatius Kamwanje said though the development is a good move, restricting the process to well-known mining districts while sidelining other districts will hinder progress of some projects especially ongoing exploration activities.

Kamwanje, therefore, asked the government to consider pumping more funds to the Authority to ensure that it has the capacity to deploy officers in all districts..

He said: “Sidelining other districts will deny other districts to develop in terms of mining because some districts have ongoing exploration activities only.”

“It will be good to level the ground by establishing offices in all districts.”

“The government should consider pumping more funds to MMRA to cater for such a process.”

A number of districts across the country have unresolved issues between communities and mining companies to do with environmental degradation, land compensation, legal issues, Corporate Social Responsibility (CSR) and health issues.

ASX-listed Chilwa Minerals says assay results received for the first hole at the Mposa geophysics rare earth elements (REE) anomaly indicate elevated to 1,039ppm Total Rare Earth Ore (TREO) values in clay and sediments and saprolite to depths of up to 80m.

Cadell Buss Founder and MD for Chilwa Minerals explains in a statement that the anomalies, considered potential REE mineralisation targets, were characterised by Thorium, Potassium, magnetic signatures, and zoned intrusive bodies. These targets have undergone ground verification through mapping, soil geochemistry, and rock-chip sampling, with subsequent diamond drilling undertaken for further evaluation.

Buss reports that a total of 1,008m was drilled at six drill holes on the Mposa geophysics anomaly, with drilling moving to the Mpyupyu area in the first week of August.

Analysis was carried out on the entire drill column, including up to 80m of sediment, clay and saprolite above the consolidated bedrock. TREO values are elevated through the entire 80m thick horizon indicating the scale of the REE potential within the Lake Chilwa Basin catchment.

Detrital sediments from metamorphosed country rocks and the later Chilwa Alkaline Province rocks (host rocks to numerous REE deposits including Kangankunde, Songwe Hill, and Tundulu) have infilled the Lake Chilwa Basin over millennia, creating a substantial deposit of lacustrine clays surrounding the lake, as well as the heavy mineral sands deposits being developed by Chilwa on Lake Chilwa’s western shoreline.

With no previous diamond drilling in the immediate vicinity, the Company has assayed the entire stratigraphy, acquiring information on the provenance of sediment deposited in the basin as well as overall understanding of the relationship between the Company’s mineral sands deposits and potential rare earth targets around the lake. A saprolite interval, interpreted from 35m to 82m also carries elevated TREO grades, relative to underlying bedrock.

Buss says although the TREO grades in the sediments and cover may warrant further investigation as an ionic adsorption clay hosted REE deposit, the Company does not plan to conduct leach testing at this time. Instead, the focus remains on identifying Carbonatite-hosted or associated REE deposits, similar to neighbouring projects like Kangankunde.

The initial drilling program for the Mposa anomaly overall has now been completed with a developed brecciation observed at multiple intervals.

Buss, comments: “This update represents yet another significant step for the company - and perhaps the most exciting to date.”

“Since receiving the results of the airborne radiometric survey in 2024, we have been confident that we have identified a substantial critical minerals asset.”

“The importance of our recent HMS announcement, which relates to a ‘rare earth mineral concentrate as a potential by-product’ of the HMS assemblage, has provided the company increased confidence regarding the presence of additional Rare Earth Elements. These results further substantiate our geological analysis.”

“We have now established a systematic exploration drilling process with core logging and sample prep at our dedicated facility in Zalewa and have a clear path ahead with a further 46 geophysics anomalies still to test.”

“The final soil sample results of all 47 targets (30 have been reported and 17 are pending ) once received, will enable us to rank targets by relative prospectivity and guide subsequent future exploration drilling.”

“We are also impressed by results to date at the second target (Mpyupyu) tested with notable fenitisation of rocks, a clear carbonatite signal in rocks near surface, as well as a barite dyke and chalcopyrite mineralisation both indicative of late stage sulphide enriched fluids in a carbonatite related hydrothermal system, and we eagerly await the assay results of this first hole.”

The Mining and Minerals Regulatory Authority (MMRA) has expressed concern over political interference in its duties saying it is one of the challenges disrupting its work of bringing sanity in the mining sector.

MMRA Monitoring and Evaluation Officer Dikani Chibwe told Mining and Trade Review that some influential politicians, he declined to mention, interrupt their mandatory work mainly when some illegal miners are arrested by the Authority.

Chibwe said: “For instance, we apprehended some illegal miners in Nkhotakota and just few hours while they were in police custody, we received calls from influential politicians demanding their immediate release.”

“The situation left the police with no choice but to release them. As a regulatory body we feel powerless in such situations which are making it difficult for us to regulate the sector.”

MMRA is mandated to regulate the mineral sector in the development and utilization of mineral resources in line with sustainable development principles and best practices for the benefit of Malawians.

Chibwe admitted that there is an increase in illegal mining practices in the country but blamed the situation on traditional leaders as the ones exacerbating the problem by illegally allocating land for mining.

Commenting on the development, Chairperson for Centre for Multiparty Democracy (CMD) Ben Chakhame blamed the public servants at MMRA for not disclosing the names of the said politicians to the public. Chakhame said the politicians were supposed to be named and shamed for others to learn a lesson.

He said: “The problem is them as public servants. They give room to this otherwise I, as a politician, if I go there and am reported, people can learn a lesson.

There are some politicians who are fueling this and they need to be mentioned.” “These are some of the things that have to come openly even in the media, people have to know. Name and shame them.”

Coordinator for Natural Resources Justice Network (NRJN) Kennedy Rashid said the political interference in the regulatory affairs simply tells how abusive and weak the system is. Rashid said politicians are only allowed in policy making as policy shareholders but not enforcement in the abusive way.

He said: “I think there is a misconception by political actors. They feel like once they are politicians they are also regulators. “Politicians are policy makers and their role is to look at policy and advice on how the policy can be formulated.”

“But implementation of the policy is left out to technicians at Capital Hill that is government machinery itself that is now supposed to enforce and regulate.”

“When politicians come in to regulate that is illegal, according to Mines and Minerals Act and they can be penalized..” Apart from political interference, MMRA is also facing the problem of understaffing making it fail to meet its targets.

Ilmenite and rutile are a source of titanium pigment and titanium metal. These minerals exist as saprolite metamorphic rocks, placer deposits in alluvial environments and beaches and as float or pods and veins in basement anorthosite. These minerals have potential to transform the economy of Malawi through mining and processing to value added products.

Ilmenite is a mineral composed of titanium dioxide and iron (FeTiO3) while Rutile is made up of titanium dioxide (TiO2). These minerals occur in igneous and metamorphic rocks. They are a primary source of titanium dioxide pigment mainly used in the production of paints, plastics, paper products and for formulating sunscreens that block harmful UV rays.

Most ilmenite in Malawi accumulates as heavy mineral sands during stream transport and wave action along lake beaches. Ilmenite can be converted into pigment grade or synthetic rutile via either sulfate process or chloride process. Ilmenite can also be smelted to produce liquid iron and a titanium-rich slag. Rutile often appears as small needles quartz and gem stones giving asterism or cat’s eye effect. The high dispersion of rutile allows it to break up white light into multi-colored points, further enhancing its optical allure.

Rutile is commonly found in igneous and metamorphic rocks, often alongside other minerals such as quartz and feldspar. . It often appears in varying reddish to brownish translucent colours.

The paragneiss of Kasiya area hosts a weathering profile of rutile mineralisation in extensive, shallow, blanket-like formations popularly known as saprolite.

The Kasiya rutile project will use hydro mining technic and the slurry material from the pits will undergo processing at the wet plant where the cyclones and up-current classifiers will be employed to eliminate fine particles smaller than 45µm. The heavy mineral concentrate (HMC) will be isolated using both coarse and fine spiral circuits to produce coarse and fine gravity tailings enriched with graphite. The graphite will be recovered through combined gravity separation of tailings using froth flotation, which will include polishing and the use of stirred media mills.

Tengani rutile/ilmenite project in Nsanje contains a combination of rutile and ilmenite with ilmenite in great abundance. The rutile/ilmenite deposit exist in form of place deposit derived from adjacent anorthositic rocks and as an ore in the Basement Complex anorthositic rocks. In the basement anorthositic rock, the ilmenite appears to exist in an intergrowth with rutile, surrounded by very abundant strongly fractured reddish-brown almandine garnet (Viv Stuart Willams, 2021). This is a common occurrence of the alluvial rutile/ilmenite deposit within the alluvial plain. Further research is required into less cost production of TiO2 product.

Makanjira Heavy Mineral Sands is a weathered eluvial layer of Precambrian gneiss containing garnet hornblende biotite. The beach placer is a loose yellow medium sand containing titanium– zirconium. Its particle size varies from 0.1 to 0.5 mm. Ilmenite and zirconite are the main constituents occurring in 0.07 - 0.30 mm size fraction and 0.07 - 0.18 mm size fraction respectively. The mud content has an average value of 0.89%. The ilmenite will be recovered through a combination of gravity, magnetic and electric separation. Lake Chilwa Heavy Mineral Sands consist of beach and dune deposits that were deposited and preserved through several cycles of lake level fluctuations.

The main HM deposits are located on a very distinct strandline where the conditions of sediment supply, lake level, and hydrological were favourable for the formation and preservation of the sand deposits.

Sediments, including HMs, were eroded and supplied by several streams and rivers flowing into the lake from surrounding basement gneiss and alkaline intrusion complexes.

The HM characteristics of each deposit are determined by the proven rock types. Some deposits have local point sources contributing to the HM assemblage.

Titanium is critical for industries like aerospace, defense, and renewables. Due to its semiconductor properties, smaller wavelength (<400 nm), high refractive indices, high birefringence and high dispeion make it a raw material for production of certain critical optical elements. Titanium dioxide can be used as a cellulose that covers welding electrodes. When converted into a metal it is used in aerospace, automotive, electronics industries, and medical devices.

Sovereign Metals has come up with a mineral resource of broad and contiguous zones of highgrade rutile and graphite across a very large area of over 201km2 within a 15-meter depth of saprolite material. A resource of 17.0 million tonnes of rutile was estimated to exist. The ore contains an average grade of 1.0% rutile. Makanjira Heavy Mineral Sands consist mainly of ilmenite and zirconite with the ore body floor composing a weathered eluvial layer of Precambrian gneiss containing garnet hornblende biotite. The Makanjila titanium-zirconium placers consist of a reserve totaling 367.5869 million tons of which Ilmenite is 9763.676 thousand tons (average grade 42.39kg/m3).

Crown Minerals estimates that the Tengani EPL contains 1.6 million tonnes of rutile. Most of the rutile is inter twinned with 7.2 million tonnes of ilmenite which calls for the use of Ortech Technology to take the titanium into solution and then recover Ti from the solutions. .

The Nkhotakota- Augustino stretch along the western shore of Lake Malawi contains an inferred resource of 18.0 million tonnes at 3.7% ilmenite.

Crown Minerals Ltd has observed pods and thin veins as a common type of mineralization in the anorthosite body. This is the main source of alluvial and eluvial ilmenite/rutile at Tengani.

The Lake Chilwa beach placer is proving to have a large deposit of ilmenite. Chilwa Minerals has come up with an Inferred Resource of 61.6Mt at 3.9 % THM.

A recent investigation by Crown Minerals on the basement anorthosite has shown that it hosts abundant titanium mineralization in the basal units of the complex. This mineralization has been observed in an area of 11 Km2. An inferred resource of 3.3 Mt has been estimated using a density of 1 Kg/m3 within a depth of 0.3 m. More work is required to prove that this can be another world class deposit of titanium mineralisation.

High-temperature chemical reaction is required to transform ilmenite and rutile into titanium dioxide (TiO2). Coal and chlorine gas are used in a fluidized bed to transform ilmenite and rutile into TiO2. Regulated high-temperature of about 1000 0C is used to turn titanium ore and chlorine gas into titanium tetrachloride, known as TiCl4. Hydrolysis and Oxidation turns TiCl4 into TiO2.

Malawi has the potential to smelt ilmenite and rutile to form titanium oxide slag and pig iron. The titanium slag or pig iron can be converted into titanium pigment using chloride process in combination with salt and cheap power.

Titanium metal is produced through the Kroll process, where it's reduced with magnesium.

For as long as she can remember, Tupoche Makileni has been fascinated by the earth beneath her feet. Growing up in Malawi as the only girl among three brothers, with a teacher for a mother and an IT technician for a father, she found herself constantly asking: What are things made of? Where do these materials come from? Those early questions lit a spark that has carried her into a groundbreaking role at the heart of Malawi’s mining sector. Today, Tupoche - 34, leads the country’s first high-tech mineral laboratory at Sovereign Services, overseeing the processing of rutile and graphite samples and managing a team of 33 professionals—25% of them women.

Her path began with A-levels and a Bachelor of Science in Earth Sciences (Geology) from the University of Malawi’s Chancellor College. In 2017, she joined the Ministry of Mining under the Geological Survey Department, before Sovereign Services spotted her talent in 2019 and brought her on as a consultant. By 2022, she had risen to Laboratory Manager, steering a facility that sets the standard for accuracy, quality, and innovation.

Her mornings start with precision—planning resources, equipment, and workflows to ensure smooth operations. But it’s more than technical skill that drives her. “Drawing inspiration from daily challenges and being able to be a solution provider inspires me to come to work every day,” she says.

In a male-dominated industry, Tupoche is proof that leadership thrives on empowerment. She ensures every team member has a voice and a stake in the lab’s success. Her management style blends sharp analysis with empathy, enabling her to guide operations while nurturing talent.

Beyond the lab, she is also a wife and mother to a 1 year old daughter, and she hopes her journey shows that excellence and balance are possible. Her advice to other women forging careers in science and mining: “Work hard, stay curious, stay focused—and don’t be afraid to make mistakes. This field is always evolving, and so should you.

” What she values most about Sovereign Services is its culture of opportunity and growth. “Regardless of gender, everyone is encouraged to develop their skills through continuous training and to rise based on capability,” she notes.

From a little girl curious about rocks to a trailblazing leader unlocking the potential of Malawi’s mineral wealth, Tupoche’s story is proof that perseverance, passion, and purpose can shape both a career and a legacy.

Sovereign Services is the Malawi operation of Sovereign Metals Limited, which is focused on developing its Kasiya Rutile-Graphite Project in Malawi to become a leading global supplier to the titanium and graphite industries.

Kasiya is the world’s largest natural rutile deposit – the purest, highest-grade naturally occurring titanium feedstock – and the world’s second-largest flake graphite deposit – a battery mineral essential for the energy transition.

- Langmed & Baker

The Federation of Artisanal and Small-Scale Mining in Malawi (FASMM) has expressed strong optimism regarding the sector’s potential to positively impact the country’s economy. FASMM emphasizes that, with adequate support and strategic interventions, artisanal and small-scale miners (ASMs) can transform livelihoods, reduce poverty, and contribute significantly to Malawi’s economic development.

FASMM President Percy Maleta made these remarks following visits to illegal mining hotspots in Lilongwe and Kasungu.

Maleta stated, “With the right policies, partnerships, and enforcement strategies, the sector can shift from being perceived as illegal to being recognized as a key driver of sustainable development.”

When asked about the motivation behind FASMM’s visits to illegal mining sites, Maleta explained that the federation aimed to understand the realities faced by miners on the ground, engage directly with artisanal miners, and explore pathways toward formalization of their activities.

He highlighted some of the challenges confronting miners in these hotspots, including lack of proper licensing, poor safety standards, inadequate equipment, limited market access, and vulnerability to exploitation.

Despite these obstacles, some success stories have emerged from the visited hotspots. Maleta noted that miners are increasingly aware of the importance of formalization and have shown willingness to organize into cooperatives.

“We have observed growing awareness among miners about the benefits of formalization, and many have expressed interest in organizing into cooperatives and engaging more openly with government structures,” he said.

Maleta said FASMM aims to formalize illegal miners by advocating for simplified licensing procedures, cooperative development, responsible mining training, and the establishment of structured markets closer to mining hotspots.

He also reiterated FASMM’s readiness to collaborate with government agencies in tackling illegal mining. “We plan to work together through joint site visits, stakeholder dialogues, and regular feedback mechanisms with the Ministry of Mining, the Mining and Minerals Regulatory Authority, and law enforcement agencies,” Maleta said.

Regarding government collaboration, Maleta suggested that authorities could involve FASMM more directly in policy formulation, support artisanal mining associations and cooperatives, and prioritize community engagement before enforcement actions.

He emphasized that the government could better support artisanal miners and curb illegal activities through a clear artisanal mining framework, decentralized licensing systems, improved access to finance, and greater recognition of cooperatives.

The Federation was established in April this year as a unifying body for the country’s artisanal miners and traders. Its founding members include the Malawi Women in Mining Association (MAWIMA), Gemstone Association of Malawi (GAM), Women in Extractive, Energy and Mining Association (WEEMA), Blantyre Mining Association, and representatives from gold miners, ceramics, quarry operators, and youth groups active in the sector.